Business Insurance in and around Baton Rouge

Baton Rouge! Look no further for small business insurance.

Helping insure small businesses since 1935

Insure The Business You've Built.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Debbie Drury. Debbie Drury understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Baton Rouge! Look no further for small business insurance.

Helping insure small businesses since 1935

Strictly Business With State Farm

For your small business, whether it's a music school, a beauty salon, a bakery, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, buildings you own, and loss of income.

Visit the exceptional team at agent Debbie Drury's office to uncover the options that may be right for you and your small business.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

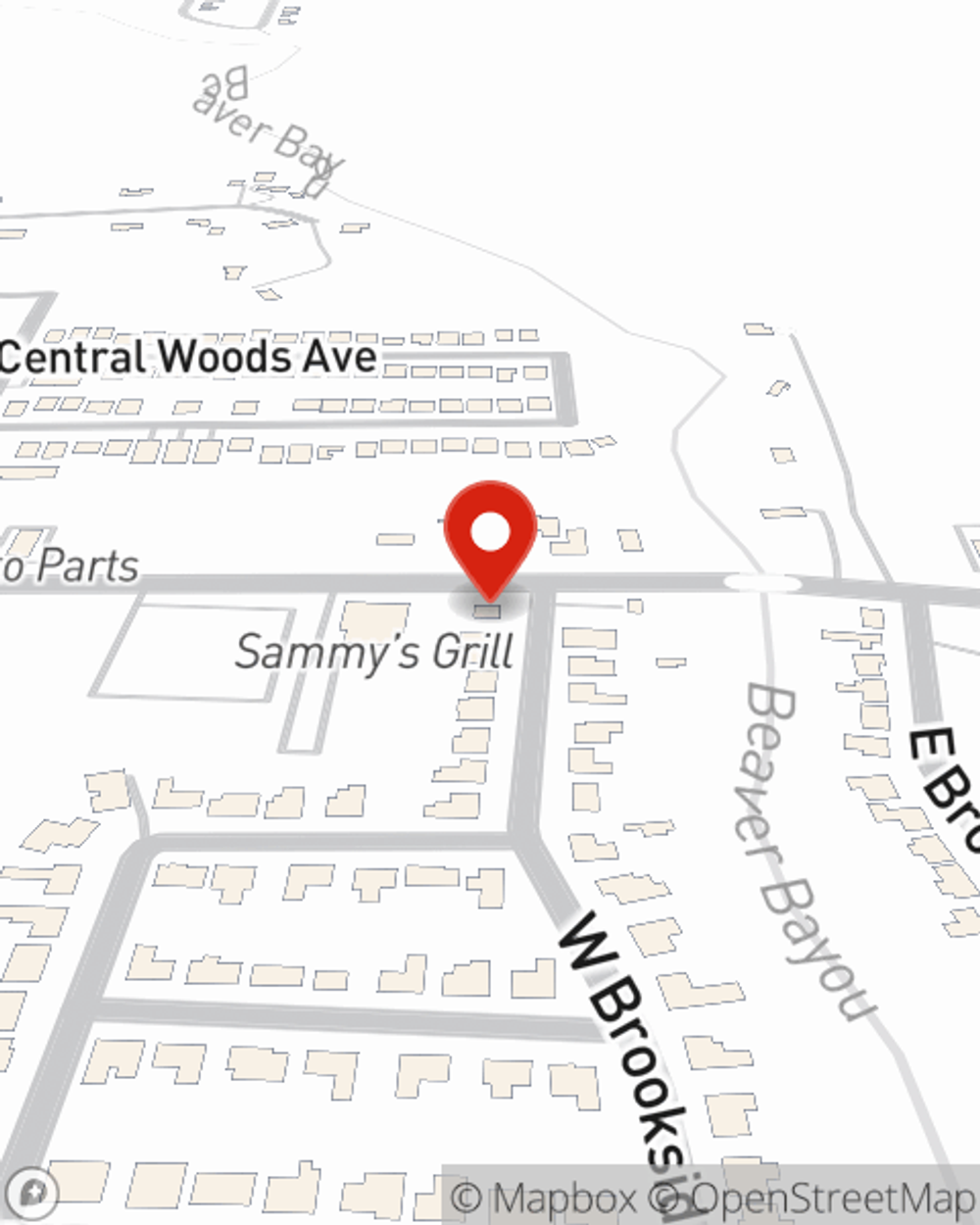

Debbie Drury

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.